In today’s fast-paced digital world, managing bills can be a real headache. But what if there was a way to streamline your payments, ensuring you never miss a due date again? Enter ACHMA VISB Bill Payment, a game-changing solution that’s revolutionizing how Americans handle their financial obligations.

In this comprehensive guide, we’ll dive deep into the world of ACHMA Visa Bill Payment, exploring its ins and outs, and showing you why it might just be the financial tool you’ve been waiting for.

What is ACHMA VISB Bill Payment?

ACHMA VISB Bill Payment, also known as ACHMA Visa Bill Payment, is an innovative electronic payment system that allows credit card holders to effortlessly settle their monthly balances directly from their bank accounts. This cutting-edge service leverages the power of the Automated Clearing House (ACH) network to facilitate seamless fund transfers between consumers and billers.

At its core, ACHMA VISB Bill Payment is designed to simplify the bill-paying process. Gone are the days of writing checks, licking stamps, and hoping your payment arrives on time. With this system, you can set up automatic fund transfers with various service providers, from credit card companies to utilities and phone providers like Verizon Wireless.

These preset amounts are deducted directly from your checking or savings account on the due date, ensuring timely payments without the need for manual intervention.

The beauty of ACHMA Visa Bill Payment lies in its simplicity and efficiency. By eliminating the middleman (in this case, the postal service), it not only saves time but also reduces the risk of late payments due to mail delays. Moreover, it offers consumers better control over their cash flow, as they can precisely time when funds leave their accounts.

How does ACHMA VISB Bill Payment Work?

Understanding the mechanics of ACHMA VISB Bill Payment is crucial to appreciating its value. Let’s break down the process step by step:

- Enrollment: The journey begins with you providing your billers (such as credit card companies, utilities, or phone providers) with your bank routing and checking account number. This step authorizes them to initiate electronic deductions through the ACH network.

- Payment Scheduling: You and your billers agree on a specific date each month or payment period when funds will be transferred. This could be, for example, the 15th of each month.

- Debit from Your Account: On the scheduled date, your biller sends a request through the ACH network to debit the agreed-upon amount from your bank account.

- Deposit to Biller: Simultaneously, the payment amount is deposited directly into the billing company’s account.

- Payment Confirmation: The transaction will appear on your next bank statement as an electronic transfer to the company you paid, serving as your receipt and proof of payment.

This streamlined process eliminates the need for paper checks, postage, and manual tracking of due dates. It’s a fully automated system that works behind the scenes to keep your finances in order.

Recommended Post: Brook Taube Wells Notice

When is ACHMA Visa Bill Payment Recommended?

While ACHMA Visa Bill Payment offers numerous advantages, it’s particularly beneficial in certain scenarios:

Paying Large Statement Balances

For consumers carrying substantial credit card balances between statement periods, ACHMA bill pay is a godsend. It helps avoid hefty interest charges by ensuring the full amount due is paid on time each month.

The funds come straight from your bank account, preventing the accumulation of interest that often occurs when balances are carried over.

Setting Up Recurring Payments

One of the standout features of ACHMA Visa Bill Payment is its ability to be configured as an automatic recurring payment. This means you can set it to occur at a preset time, such as the same day each month.

This automation is a powerful tool in preventing missed or late payments, which can negatively impact your credit score. It’s particularly useful for bills that remain constant, like mortgage payments or fixed-rate loans.

Lacking a Credit Card

In situations where a credit card is unavailable – perhaps you’ve left it at home or are waiting for a replacement – ACHMA VISB bill payment provides a reliable alternative. You can still access funds from your bank account to make timely payments, ensuring your bills are covered even without your physical card.

Preferring not to use Credit

Some consumers simply prefer not to rely on credit cards, whether for budgeting reasons or personal finance philosophies.

ACHMA Visa Bill Payment allows these individuals to directly pay balances with available bank account dollars, providing a sense of financial control and helping to avoid the temptation of overspending that sometimes comes with credit card use.

Benefits of ACHMA VISB Bill Payment

The advantages of using ACHMA VISB Bill Payment are numerous and impactful:

- Convenience: Once set up, you no longer need to write, sign, and mail checks each month. Payments are automated, saving you time and mental energy.

- Time Savings: Say goodbye to trips to the post office or waiting for payments to arrive by mail. Funds are transferred directly between accounts on scheduled dates, freeing up your time for more important tasks.

- Enhanced Security: Since payments are processed electronically rather than with physical checks, there’s no risk of theft, loss, or delayed delivery in the mail system. This adds an extra layer of security to your financial transactions.

- Avoidance of Late Fees: With payments deducted automatically on the scheduled due date, you eliminate any chance of forgetting and incurring costly late fees. This can lead to significant savings over time.

- Cost-Effective: ACHMA Visa payments are typically free for users, with no additional cost beyond your regular bank account fees. Many billers offer this service at no extra charge, making it a budget-friendly option for managing your finances.

- Improved Financial Organization: With all your bill payments automated and recorded electronically, it’s easier to keep track of your expenses and maintain a clear financial picture.

Comparing ACHMA Visa Payment to Other Options

To truly appreciate the value of ACHMA VISB Bill Payment, it’s helpful to compare it to other common payment methods:

| Payment Method | Pros | Cons |

| ACHMA Visa Payment | Free, fast, convenient, tracks in bank statements | Funds come directly from account, can’t earn credit card rewards |

| Credit Card Payment | Rewards points, maintains credit utilization | Interest charges accrue without paying full statement amount |

| Online Bank Bill Pay | Free, tracks payments in online account | Funds may take 3-5 business days to reach issuer |

| Mailing Paper Checks | No account information shared each time | Reliant on mail delivery, must remember to mail on time |

| In-Person Payment | Immediate processing if paying at bank branch | Requires travel, limited hours may be an issue |

As this comparison illustrates, ACHMA Visa Bill Payment offers a unique combination of convenience, speed, and cost-effectiveness that sets it apart from other payment methods.

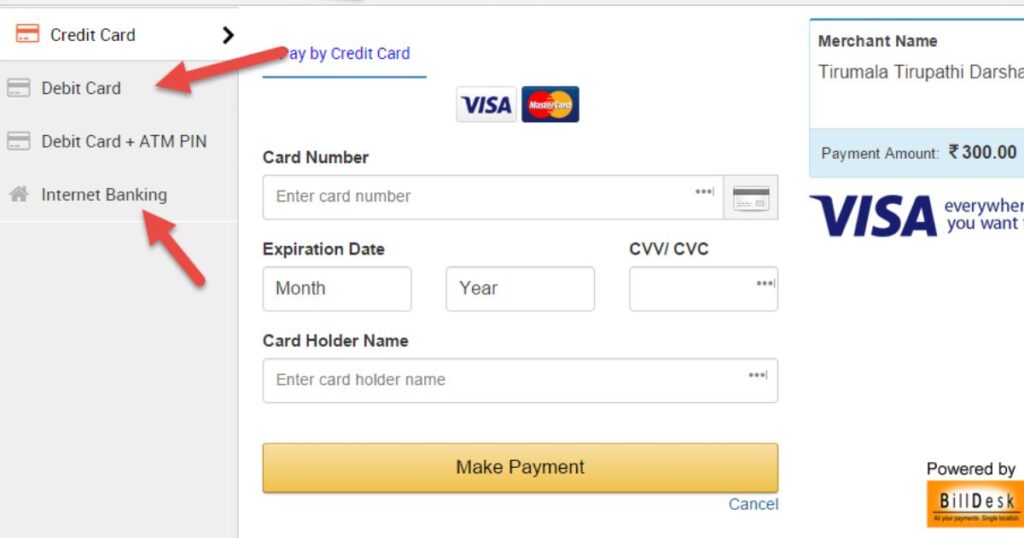

Setting Up ACHMA Visa Bill Payments

Getting started with ACHMA Visa Bill Payments is a straightforward process. Here’s how you can set it up with two popular providers:

Setting Up With Verizon Wireless:

- Log into your Verizon Wireless account online or open the My Verizon mobile app.

- Navigate to the “Pay Bill” section and click “Edit payment information.”

- Choose the “Automatic payment” option and select your preferred payment date.

- Input your bank routing and account numbers. Note that verification of your account may be required.

- Double-check all information before saving your payment profile.

Setting up with a Major Credit Card Issuer:

- Access your online credit card account portal through the issuer’s website.

- Locate the payment options and click on “Set up automatic payments.”

- Select your preferred payment frequency, such as monthly on the statement due date.

- Enter your 9-digit routing number and full checking account number.

- Verify all account details and submit to establish ACHMA payments.

Important Factors to Consider

While ACHMA VISB Bill Payment offers numerous advantages, there are several key factors to keep in mind:

- Ensure Sufficient Funds: Your bank account must have adequate funds available on the scheduled payment date. Failure to do so could result in overdraft or insufficient funds fees.

- Notify Billers of Changes: If you need to change your bank account information, payment date, or amount, contact your billers immediately to avoid failed payments or errors.

- Check Bank Statements: Regularly review your transactions online or on paper statements to confirm payments were processed correctly each month from your account.

- Keep Records: Save payment confirmation details for tax purposes, receipts, or in case any discrepancies need to be addressed later with your billers.

By keeping these factors in mind, you can maximize the benefits of ACHMA VISB Bill Payment while avoiding potential pitfalls.

ACHMA VISB Bill Payment in Action: A Case Study

To illustrate the real-world impact of ACHMA VISB Bill Payment, let’s consider a hypothetical scenario involving a monthly Verizon Wireless phone bill:

Traditional Method: Peter pays his $120 Verizon bill by check each month. He must remember to write out and mail his payment at least 5-7 days before the due date. There’s always a risk the check may arrive late and incur fees.

ACHMA VISB Method: Peter signs up for ACH bill payment online. On the 12th of each month, $120 is automatically deducted from his checking account and deposited into Verizon’s bank. Peter receives email/text confirmations and no longer has to worry about mailing payments on time. His account stays in good standing without extra effort each month.

This case study demonstrates how ACHMA VISB Bill Payment removes the hassle and uncertainty around due dates compared to traditional paper check methods. The process becomes entirely digital and hands-free once enrolled, providing Peter with peace of mind and more time to focus on other aspects of his life.

Read this Post: NWEDI Payments Flex Charges on your Bank Statement

Additional Use Cases for ACHMA VISB Bill Payment

The versatility of ACHMA VISB Bill Payment extends far beyond credit card and utility payments. Here are some additional scenarios where this payment method shines:

- Mortgage or Rent Payments: Property managers and loan servicers often offer tenants and homeowners the ability to pay monthly housing costs automatically through ACH.

- Student Loans: Many federal and private student loan providers allow loan payments to be scheduled and deducted directly from a designated bank account.

- Insurance Premiums: Homeowners, auto, and other insurance policies can typically be paid using recurring ACH transactions instead of mailing paper checks each month or quarter.

- Membership & Subscriptions: Whether for gyms, streaming services, or membership organizations, ACHMA bill pay enables auto-renewal without manual effort.

These use cases demonstrate the wide-ranging applicability of ACHMA VISB Bill Payment in simplifying various aspects of personal finance.

Potential Fraud or Errors with ACHMA VISB Payments

While ACHMA VISB Bill Payment is generally secure, it’s important to be aware of potential risks:

- Unauthorized Charges: In rare cases, unauthorized ACH transactions may occur. Federal regulations, including Regulation E, protect consumers by requiring banks to investigate claims and credit accounts within specific timeframes.

- Biller Errors: Occasionally, payments may be incorrectly processed or accounted for due to technical or human mistakes. It’s crucial to contact billers promptly to resolve any issues.

- Phishing Attempts: Scammers may try to steal bank account credentials through fake emails or payment pages. Always verify the authenticity of payment requests and use secure, official channels for setting up ACHMA payments.

Despite these potential risks, ACH bill payment remains an exceptionally secure means of transferring funds when used properly through authorized companies and with vigilance against potential scams.

FAQ’s

What is Achivr Visb Bill Payment?

Achivr VISB Bill Payment is another term for ACHMA VISB Bill Payment, referring to automatic payments set up through the ACH network to pay bills directly from a checking account.

What does Achma Mean?

In this context, Achma is shorthand for ACH (Automated Clearing House), the electronic network that processes bill payments between bank accounts.

What is Visb?

Visb likely refers to debit/credit cards on the Visa network, such as Visa cards linked to consumers’ bank accounts, which are often used for ACH bill payments.

Are there any Fees?

ACHMA Visa payments are typically free for both consumers and merchants. However, it’s always wise to confirm with your bank and biller.

When will the Payment be Deducted?

The payment will be deducted on the date chosen during setup, typically the statement due date. Allow 2 to 3 business days for funds to reach the issuer.

How do I Change Bank Account Information?

Log into your online account and locate the payment profile section. Update details as needed and verify the new information.

What if I need to Skip a Month?

Contact customer support in advance to temporarily disable automatic payment for that billing cycle.

Can I still Pay in Advance if I Want?

Yes, ACHMA Visa typically allows one-time additional payments over minimum amounts due at any time.

Conclusion

ACHMA VISB Bill Payment represents a significant leap forward in personal finance management. By leveraging the power of the ACH network and the convenience of digital banking, it offers a streamlined, secure, and cost-effective way to handle recurring payments. From credit card bills to mortgages, student loans to subscriptions, this versatile system can simplify a wide range of financial obligations.

As we look to the future, the role of ACHMA VISB Bill Payment in the USA is likely to grow. With increasing emphasis on digital solutions and financial efficiency, more consumers and businesses are likely to adopt this payment method. Its ability to reduce late payments, save time, and provide better financial oversight makes it an attractive option for anyone looking to streamline their bill-paying process.

If you haven’t already, consider exploring ACHMA Visa Bill Payment for your recurring expenses. It could be the key to unlocking a more organized, stress-free financial future. Remember, the path to financial wellness often begins with small, smart changes in how we manage our day-to-day transactions. ACHMA VISB Bill Payment might just be the change you’ve been looking for.

I have styled looks for Fashion Week runway shows and magazine editorials. My blog shares my passion for trends and provides outfit inspiration, and tips for developing your signature personal style.