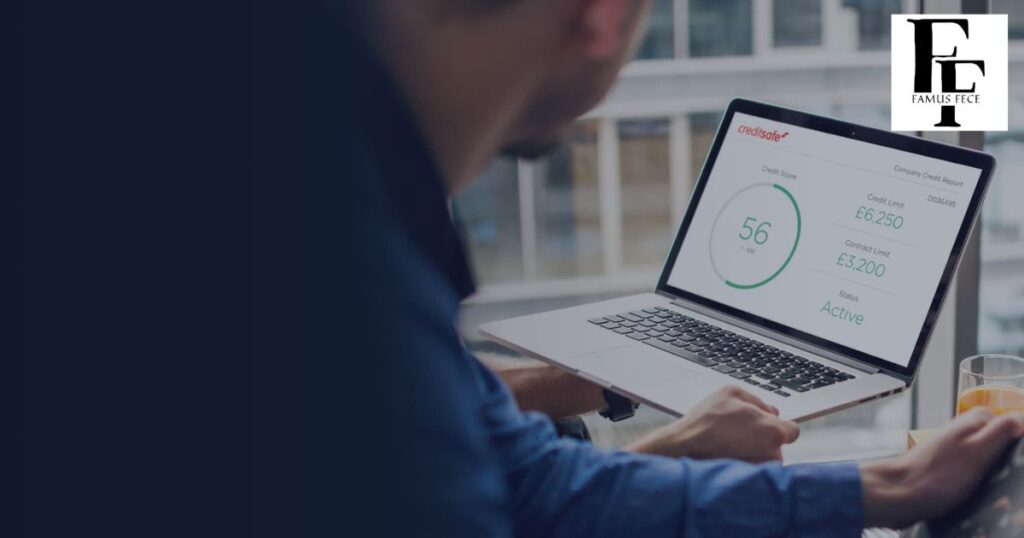

It can be confusing and concerning to see unfamiliar things. One code some people see is “WF CRD SVC.” If you’ve come across this and want to know what it means and how to remove it if needed, then keep reading.

This article will explain precisely what the WF CRD SVC code stands for in plain terms. It refers to a request for your credit history from the financial company Wells Fargo. The article discusses why these requests, also called “hard inquiries,” may show up on your report and how they can potentially impact your credit score.

More importantly, it provides clear steps on what to do if you find an inaccurate or unauthorized WF CRD SVC inquiry listed. By learning about this code and your options for addressing it, you can keep your credit report and score in the best shape.

What does WF CRD SVC mean?

The letters WF stand for Wells Fargo, which is a large bank in the United States. CRD SVC means Credit Services – it’s the division of Wells Fargo that handles things like credit cards, loans, mortgages, and other services that involve borrowing money.

So, together, WF CRD SVC refers to a request made by Wells Fargo to check your credit history when you apply for one of their financial products. They do this to see if you’d be a safe or risky person to lend money to.

How does WF CRD SVC affect my credit report?

When a lender like Wells Fargo checks your credit report, known as a “hard inquiry,” it can potentially lower your credit score a small amount. This is only temporary in most cases. The main thing is that any hard inquiries stay on your report for two years.

Other lenders who see multiple inquiries over a short time may think you’re trying to borrow a lot of money and won’t pay it back. While one WF CRD SVC inquiry alone usually helps a little doesn’t, it’s essential to get any errors removed so they don’t cause problems down the road.

How do I remove WF CRD SVC from my credit report?

If you see a WF CRD SVC entry on your report that you don’t recognize and don’t believe you applied for credit from Wells Fargo, there are a few things you can try. It’s essential to act quickly, as you want inaccurate information off your report as soon as possible.

You can dispute the inquiry directly with Wells Fargo, the credit bureaus that keep your file, or work with a credit repair company to help remove it.

Contact a credit repair service.

A credit repair service is a company that explicitly helps people fix mistakes or errors on their credit reports. They know the process well for removing things like hard inquiries that should be elsewhere.

A credit repair service will investigate where the WF CRD SVC request came from, build a case showing it’s fraudulent, and handle communicating with Wells Fargo and the credit bureaus on your behalf to get it taken off. This can be a good option if you need clarification on the dispute process or need more time to do it yourself.

Read More About: SP AFF* Charge On Your Bank Statement

Dispute the check with the report issuers.

If contacting a credit repair agency isn’t an option, you should dispute the WF CRD SVC inquiry directly with Wells Fargo. They were the company that initiated the check on your report.

To do this, call Wells Fargo and ask them to submit a dispute regarding a hard inquiry on your credit report. Explain that you didn’t request credit from them and want to know how the check appeared. Wells Fargo will review records and could agree to remove the inquiry if it was made in error.

Dispute the check with credit bureaus.

As an alternative, you can dispute inaccurate information with credit bureaus like Equifax, Experian, and TransUnion. These are the companies that collect your credit history and reports.

To argue with them, you’ll need to submit letters or fill out dispute forms explaining that a WF CRD SVC check was misreported. The bureaus will then contact Wells Fargo to verify the claim. If the bank can’t prove you requested credit, the bureaus have to eliminate the entry from your credit reports. This route ensures any errors are fixed across all your credit files.

Why should I report WF CRD SVC?

It’s essential to address any inaccuracies on your credit report as soon as possible. An incorrect inquiry like WF CRD SVC could end up hurting your credit score over the long run if addressed.

Each time you apply for new lines of credit, lenders will see that inquiry when pulling your file. Even though one inquiry alone may not drastically impact the score, multiple inaccuracies raise red flags. They can prevent you from getting the best interest rates on loans, credit cards, and more.

Reporting a WF CRD SVC inquiry that shouldn’t be there is the only way to get it removed and avoid future damage. Once the bureaus or Wells Fargo validate there was an error, your record will be updated.

This protects your ability to borrow affordably and prevents identity theft or further mix-ups down the road. With inaccurate inquiries removed, your score can rebound more quickly over time. Taking action is the best way to keep your credit report and status in the best possible shape.

FAQ’s

How long does it take to remove a WF CRD SVC entry?

It can typically be removed within 30-45 days if you dispute it directly with Wells Fargo or the credit bureaus. Faster solutions may be possible by hiring a credit repair agency to handle the dispute for you.

What evidence do I need to dispute a WF CRD SVC inquiry?

You don’t necessarily need firm evidence, but it’s good to note the date it appeared and state you have no record or recollection of requesting credit from Wells Fargo on that date. Having any account statements from the period could also support your claim.

Will removing it affect my relationship with Wells Fargo?

Removing an incorrect inquiry through the dispute process will only impact existing accounts you have with Wells Fargo, such as bank accounts or loans. The bank understands accurate credit reports are essential for all consumers.

What happens if my dispute is denied?

If the dispute is denied, you can appeal the decision by submitting another letter asking for it to be re-reviewed. You can also get a credit report from another bureau to see if the item shows up there inconsistently. A credit repair company may also have better success disputing it.

Will removing it increase my credit score instantly?

No, your credit score won’t jump up immediately. However, over time, as the inaccurate inquiry ages and rolls off your report, your available credit utilization and credit mix factors should see an incremental improvement, gradually raising your score in the months after removal.

Final Thoughts

Understanding common acronyms that appear on your credit report, like WF CRD SVC, is essential for protecting your credit health and score over time. While one misreported inquiry alone may cause minimal harm, it’s best to address inaccuracies promptly before they multiply down the road.

By reporting questionable items to the bureaus or issuers early, you preserve your ability to access new loans and credit cards at reasonable rates in the future. With diligence in reviewing reports regularly and inquiring about unfamiliar items, you can work to avoid the lasting damage of unresolved errors. Overall, credit management requires checking in on accounts routinely and taking quick action if issues are spotted.

If you have any WF CRD SVC entries or other codes you don’t recognize on your credit reports, don’t hesitate to initiate disputes using the methods outlined here. Getting improper items removed only takes effort upfront but helps safeguard your creditworthiness for years to come. With accurate reports, you’ll feel confident freely using credit for large and small purchases while maintaining financial resilience.

Experienced website administrator Specializing in general topics. Skilled in managing content, Optimizing User Experience, and ensuring site functionality. Dedicated to Delivering Quality and Engaging online experiences for Visitors.